We sat down, and created what a typical young adult’s budget might look like. He was having trouble visualizing what his next step in life would look like – moving out into an apartment as an older teen. This is the sample budget I created with my own 18-year-old brother several years ago. Sample Budget for 18-Year-Old – Who Will be Getting an Apartment

Psst: wondering how much money an 18-year-old should have saved? 2. Next up, a sample budget for teens that will be getting their own apartment. However, they are both paying rent and their gas costs – keeping their parents happy – and will be looking at a better tomorrow (since they’re saving as aggressively as they can for a car). There’s not much wiggle room with this budget. They’re paying $25 to their parents for gas, and using their parent’s car.This is a weekly budget, so monthly costs like rent are divided by 4 ($100/4) to show how much money they need to set aside each week to be able to pay it for the month.That means that each week, they have atleast $225 to budget with from their paycheck. In this example, the 18-year-old makes $900/month, with a bi-weekly paycheck of $450. Next up, we looked at what a typical 18-year-old budget COULD look like for someone still living at home. It was an extremely eye-opening experience for him. This is where this 18-year-old was at with teenage money management, at the time we sat down to do this. His real-world expenses (such as $100 in rent) were completely unrealistic because he was still living at home.He was spending 131% of his income on wants.His cigarette habit was costing him almost 14.7% of his entire budget.

#BUDGET PLANNER FOR TEENAGER LICENSE#

His transportation costs of using Uber were eating up $400 of his $450 in income each month…meaning it almost wasn’t worth it for him to work until he got his license (though gaining work experience is valuable, too).Is spending approximately $258.96 each month MORE than what he earns.Here’s the scrap of paper we used, showing his actual budget on a monthly income of around $450:Īside from my chicken-scratch handwriting…can you notice a few things? Then, we worked on a sample 18-year-old budget so that he could see what his COULD look like.įortunately, I saved this information as well! We first worked on his actual budget – what he was actually earning and spending right now. When my brother and I sat down, he just could not understand where all his money was going to. That’s why we’re starting with a sample budget for 18-year-olds for where they are right now. You want your 18-year-old to not only budget sometime in the future, but to get on top of their budgeting right where they are. Sample Budget for 18-Year-Old – Where They’re at Now

#BUDGET PLANNER FOR TEENAGER PLUS#

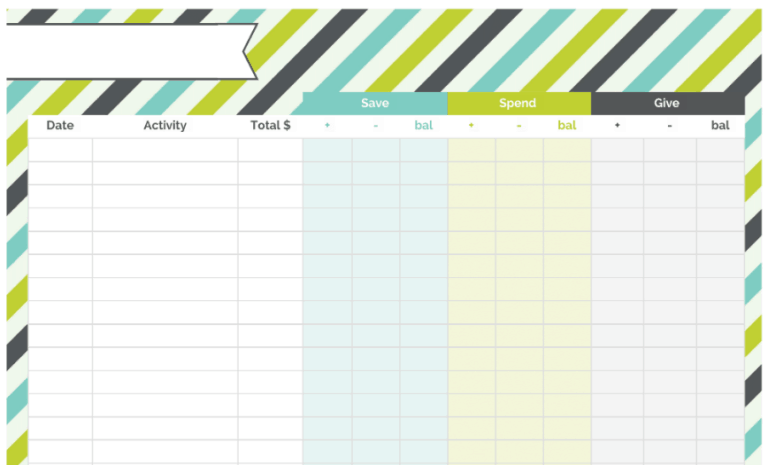

I’ll show you samples of each of these types of budgets, plus give you a budget sheet to help them create each. It'll help with a teen improving their budgeting skills. A budget for a back-up scenario for their next step in life.A budget for their ideal scenario for their next step in life.They may not even be graduating high school for another year, depending on when their birthday falls (here are smart ways to spend your graduation money).Īll of these reasons are why I urge you to create several different budgets – they’ll give you an idea of what you’re looking at, and what could be.They may not know what they’re going to do with their lives yet (apartment? College? Living at home longer? Gap year?).Your young-adult-still-teen may only have steady income seasonally, like in the summer (here are sources of income for 18-year-olds).I mean, let’s face it: things change quickly at this age. So, let’s get started! How Should an 18 Year-Old-Budget?įirst up, how should an 18-year-old budget? Not only was I able to help him that day, but I saved the exact scratch paper we used so that I could create an article to help you and YOUR 18-year-old with this task. You can imagine how much my eyes lit up! I was super happy to sit down with him and show him what a typical 18-year-old budget looks like.

0 kommentar(er)

0 kommentar(er)